Florida

Mortgage lenders .com provide Florida first time home buyers and current

Florida home owners the ability FHA

mortgage a Florida home with less than 3.5% down payment or Florida FHA

refinance a Florida home up to 96.5% of the home value. Research Florida home

loan programs which help you to buy a Florida home. Also, learn about FHA

minimum credit requirements, or get pre-approved today.

Florida-Mortgage-Lenders.com will show you the advantages of how to qualify for

an Florida FHA mortgage if you have bad credit or even no credit.

SAME DAY PRE APPROVALS!

ü

Down payment only 3.5% of the purchase price.

ü

Gifts from family or Grants for down payment

assistance and closing costs OK!

ü

Seller can credit buyers up to 6% of sales price

towards buyers costs.

ü

No reserves or future payments in account

required.

ü

FHA regulated closing costs.

ü

Purchase a Florida home 12 months after a

chapter 13 Bankruptcy

ü

Purchase a Florida 24 months after a chapter 7

Bankruptcy.

ü

FHA will allow a FHA mortgage 3 years after a Foreclosure.

ü

Minimum FICO credit score of 580 required for

96.5% financing.

ü

Bad credit Florida FHA mortgage approvals

minimum FICO credit score of 530 required for 90 FHA financing.

ü

No Credit Score Florida mortgage loans & No

Trade Line Florida FHA home loans.

ü

FHA allows higher debt ratio's than any other

Florida home loan programs.

ü

Less than two years on the same job is OK!

ü

Self-employed buyers can also qualify for FHA.

ü

Check Florida FHA Mortgage Articles for more

information.

THE FHA ADVANTAGE- FHA loan applicants will find that they

can purchase a home with less than 4% down payment and less than perfect

credit. FHA home loans are NOT just for first time Florida home buyers moving

up Florida home buyers can also take advantage of this loan program for a

primary residence. FHA will also finance Florida mortgage applicants no credit score to purchase a home as a primary residence.

Moreover, current Florida homeowners can FHA refinance up to 97.75% of the

homes value. Florida mortgage applicants will find it hard to find another home

loan program with this many advantages. Below are detailed many of the

highlights you will only find with an FHA loan:

FLORIDA FHA HOME BUYER ADVANTAGES

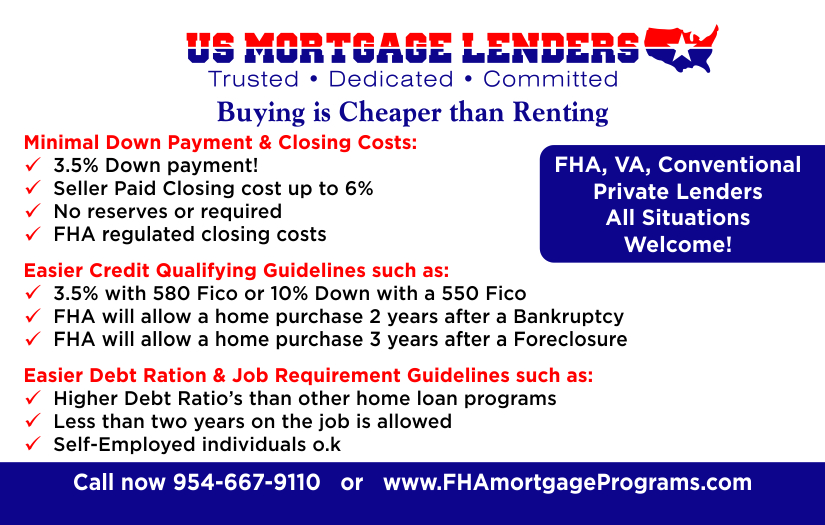

FHA LOANS HAVE MINIMAL DOWN PAYMENT AND CLOSING COST:

Down payment only 3.5% of the purchase price.

Gift's and Grants for down payment and closing costs OK!

Seller can credit up to 6% of sales price towards buyers

costs.

No reserves or future payments in account required.

FHA regulated closing costs.

FHA MORTGAGES HAVE EASIER CREDIT QUALIFYING GUIDLINES SUCH

AS:

12 months after a chapter 13 Bankruptcy.- 2 years after a

chapter 7 Bankruptcy.

FHA will allow a Florida home purchase 3 years after a

Foreclosure.

Minimum FICO credit score of 580 for 3.5% Down payment.

Minimum FICO credit score of 530 for 10% Down payment.

No Credit Score Florida home loans & No Trade Line

Florida FHA home loans.

FHA LOANS ALLOW HIGHER DEBT TO INCOME & EASIER JOB

QUALIFYING:

FHA allows higher debt ratio's than any other Florida home

loan programs.

Less than two years on the same job is OK!

Self-employed buyers can also qualify for FHA.

FREE CONSULTATION ::

GET PRE APPROVED NOW

BENIFITS OF FHA MORTGAGE REFINANCING

FHA CASH OUT REFINACE UP TO 85% LTV- LOAN TO VALUE

FHA Cash out up to Consolidate first and second Florida home

loans into a single FHA mortgage.

FHA refinance to bill consolidate higher interest debt.

Easier credit and income qualifications.

FHA mortgages have regulated closing costs.

FHA REFINANCE YOUR RATE AND TERM UP TO 96.5%:

FHA refinance to consolidate first and second mortgages into

a single FHA loan.

No credit score required no credit score refinancing options

with proof of timely payments.

Better FHA mortgage rates for loan applicants with a

Bankruptcy older than (2) two years.

Better FHA rates for borrowers with a Foreclosure older than

(3) three years.

Easier credit and income qualifications.

FHA regulated closing costs.

FHA STREAMLINE REFINANCE AN EXISTING FLORIDA FHA MORTGAGE

No out of pocket cost for FHA mortgage refinance interest

rate reductions programs.

No income or FHA credit qualifications.

Zero FHA loan closing out of pocket refinance options

available.

Easily switch lower interest or amortization schedule from

adjustable to fixed or vice verse.

Use FHA refinancing to easily shorten or lengthen term of

your existing Florida mortgage.

Easier credit and income FHA loan qualifications.

FLORIDA FHA REVERSE MORTGAGES TO ELIMINATE PAYMENTS:

Current Florida homeowners age 62 years or older and have

allot of equity in your Florida home you maybe able to refinance your existing

Florida mortgages and rid yourself of monthly mortgage payments.

MORE GREAT REASONS TO TAKE ADVANTAGE OF THE FHA MORTGAGE

BAD CREDIT FHA

MORTGAGE APPLICANTS-The FHA loan program exists to expand the pool of Florida

home buyers. Even low credit score FHA loan applicants with prior troubles get

approved for an FHA home loan every day. FHA loan applications with chapter 13

bankruptcies that can prove a 12 month timely payment history get pre approved.

FHA loan applicants that suffered from a chapter 7 must wait 24 months after

discharge to qualify. Even homeowners with past foreclosures more than 36

months old or 3 years old can qualify but a Florida in every Florida city and

county. The FHA mortgage will always relies

more on recent payment history

rather than credit score.

FHA MORTGAGE ALLOW FOR EASIER QUAIFYING–Florida home buyers

will find the FHA loan is the last stop to qualify for a decent Florida home

loan. Meaning if you don’t qualify for FHA you probably wont qualify for any

other Florida mortgage program. The FHA loan insures private Florida lenders

against loss for loans made to properly qualified Florida home buyers and

owners. So regardless to say you're likely to find FHA mortgage loans with

terms and conditions easier for you to qualify.

FHA MORTGAGE HAS LOWER LOAN COST- FHA loan rates are

extraordinarily competitive. FHA's lower risk to the Florida mortgage lender

means a better rate for the FHA loan applicant.

FORECLOSURE AVOIDANCE FOR FLORIDA HOMEOWNERS- Safeguards For

Florida homeowners that Fall behind - The FHA loan also allow the lender more

options in helping FHA mortgage borrowers who fall behind keep their homes are

get current on the payment. FHA loan provide special protections that no other

loans provide including: special forbearance, workouts, even free FHA mortgage

counseling. In addition, HUD can allow the lender to take past due payments and

move them to the end of the loan and in some instance will actually pay your

past due payments current for you. These FHA loan protections allow Florida borrowers to save

their home. You'll never find these foreclosure avoidance programs from a

conventional home loan! In an uncertain world, this is another excellent reason

for you to take advantage of the FHA home loan.

FHA MORTGAGE LOANS FOR MANUFACTURED FLORIDA HOMES-Under

certain conditions, you can even FHA finance a Florida manufactured home and

land package built before after 1977. These land home packages include mobile

or modular home loan financing or using a Florida FHA mortgage loan.

FHA MORTGAGES ARE

FULLY ASSUMABLE FOR FLORIDA HOMEBUYERS-When you are ready to sell your Florida

Home, you can offer other Florida home buyers FHA financing! All FHA loans can

be assumed by qualified home buyers.

SUMMING UP THE FHA MORTGAGE PICTURE-The FHA mortgage has

expanded since created in 1934 to include a variety of different Florida home

loan applicants in numerous situations. As a result FHA Florida mortgage

lenders can now offer Florida fist time home buyers and moving up buyers the

security of a government insured FHA Mortgage.